Beyond Spreadsheets: Your Guide to the Best Budgeting Apps in Singapore (2025)

In today's fast-paced digital world, managing your finances has evolved far beyond the traditional spreadsheet. A new generation of budgeting apps offers a world of convenience, providing real-time insights, automatic tracking, and a clear overview of your financial health. Whether you're a local navigating rising costs or an expat managing multi-currency accounts, the right app can be a powerful tool for achieving your financial goals.

At TallRock Capital, we believe that effective financial planning starts with a clear understanding of your cash flow. While these apps provide a fantastic foundation, they also generate the data you need to have a more meaningful conversation with a financial advisor. Here is our curated list of the top budgeting apps in Singapore for 2025.

Quick Comparison: Top 5 Budgeting Apps in Singapore

|

App Name |

Best For |

Bank Syncing (SG) |

Pricing (SGD) |

|---|---|---|---|

|

YNAB |

Zero-based budgeting & expert support |

Yes |

$19.18/month (after free trial) |

|

Spendee |

Multi-currency and shared budgeting |

Yes |

$5.50/month (Premium) |

|

Money Manager |

Detailed feature-packed tracking |

No |

$8.98 one-time purchase |

|

Money Lover |

All-in-one money management |

Yes |

$27.00 one-time purchase |

|

Monefy |

Simple, intuitive interface |

No |

$5.98 one-time purchase |

The Best Budgeting Apps for a Smarter Financial Life

1. YNAB (You Need A Budget)

YNAB is more than just a budgeting app; it's a proven financial philosophy. Built on a zero-based budgeting system, it helps you give every dollar a job, ensuring that you're intentional with every dollar you earn. This proactive approach helps you manage your spending, pay off debt, and save for your goals with greater confidence.

Key Features:

Zero-Based Budgeting: This unique system helps you prioritize spending and save for your goals more effectively.

Bank Account Syncing: Syncs with major banks in Singapore to automatically import and categorize transactions.

Educational Resources: Offers a dedicated support team, live workshops, online tutorials, and guides.

Debt Management: Includes an integrated loan calculator to help you get out of debt faster.

Pricing: After a 34-day free trial, YNAB costs $19.18/month or $139.48/year.

Download: App Store | Google Play

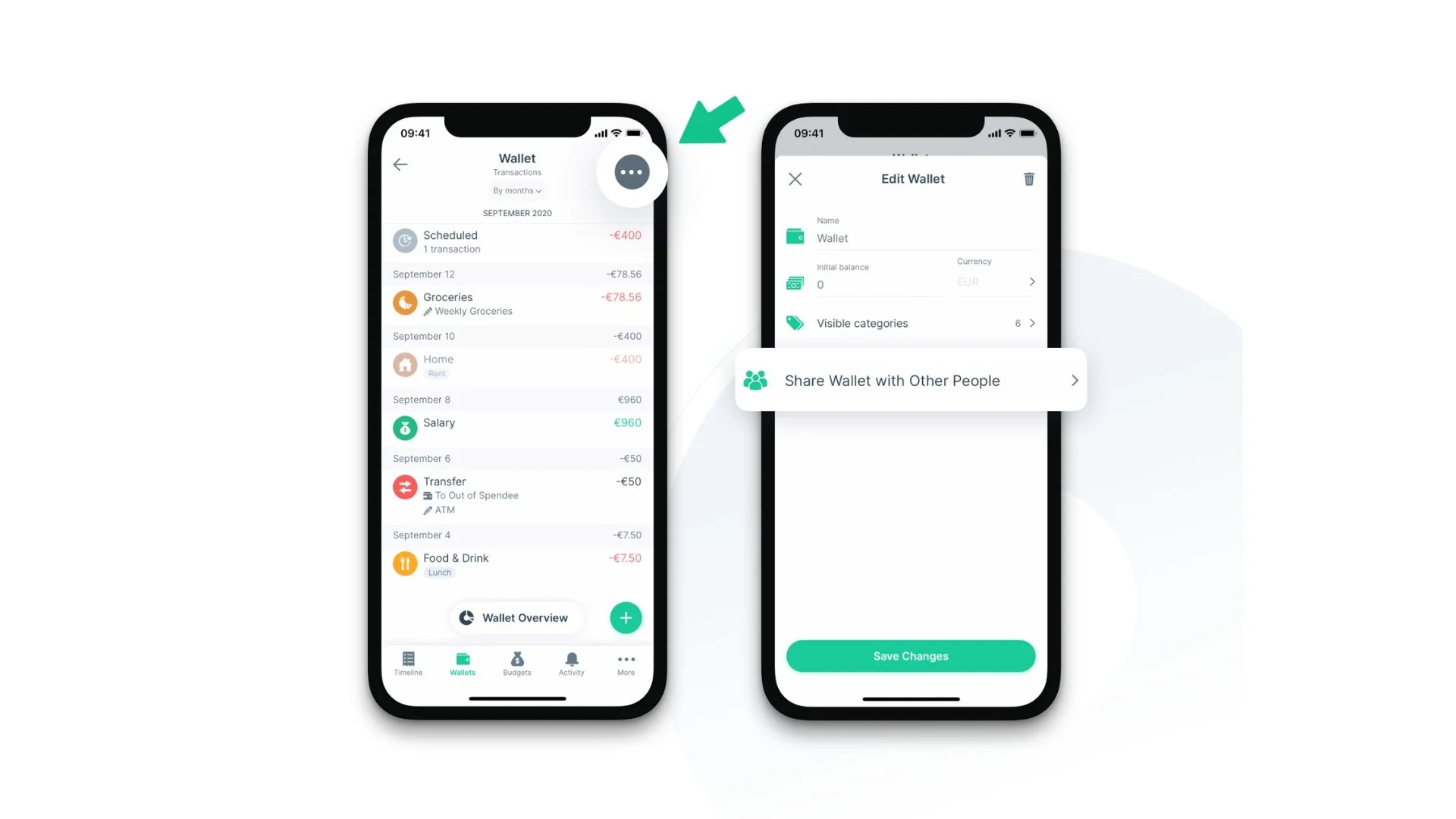

2. Spendee

Spendee is a visually driven budgeting app that helps you track daily expenses, plan budgets, and manage both personal and shared finances. It's an excellent choice for those who want to see their financial habits in a clear, easy-to-read format.

Key Features:

Multi-Currency Support: Ideal for expats and frequent travelers who manage multiple currencies.

Shared Wallets: Perfect for couples, families, or roommates who want to track shared expenses.

Bank Account Syncing: The premium plan allows you to sync with your bank accounts for automatic tracking.

Custom Categories: You can create custom categories and color-coded budgeting visuals to make tracking more intuitive.

Pricing: The free version offers basic features. Spendee Premium costs $8.10/month or $48.60/year.

Download: App Store | Google Play

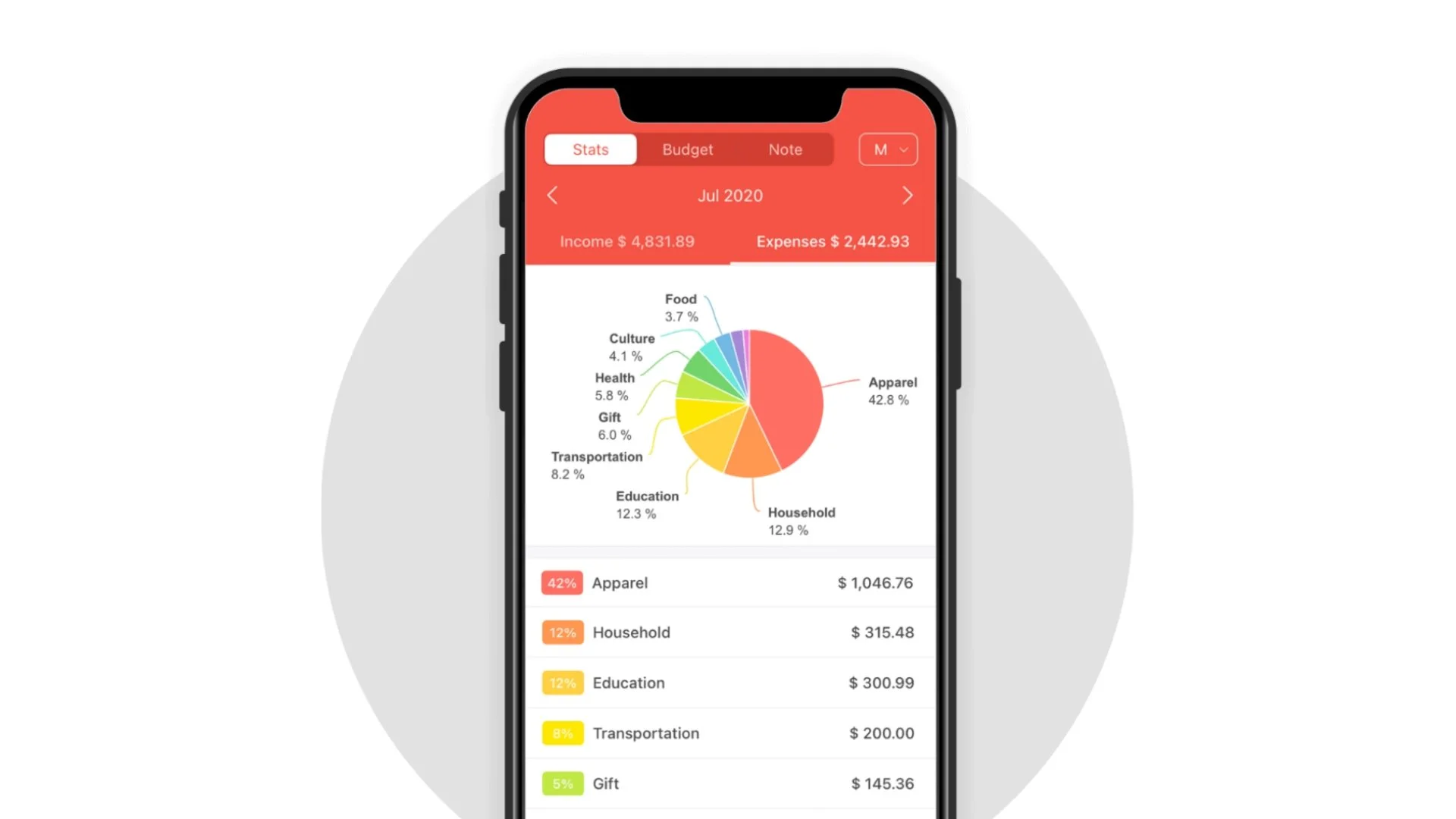

3. Money Manager Expense & Budget

Money Manager is a powerful and feature-packed budgeting app that is ideal for users who want to budget efficiently with minimal fuss. Its simple interface, along with its double-entry bookkeeping system, provides a comprehensive overview of your finances.

Key Features:

Double-Entry Bookkeeping: This system provides efficient asset management and accounting.

Budget and Expense Management: The app shows your budget and expenses in a clear graph, allowing you to quickly compare the amount of your expenditures against your budget.

Credit/Debit Card Management: You can enter a settlement date to see the payment amount and outstanding payment at the asset tab.

PC Version: The paid version gives you access to a PC version for web use and unlimited assets.

Pricing: The app offers a free version with plenty of features. The paid version costs $8.98 for a one-time purchase.

Download: App Store | Google Play

4. Money Lover

Money Lover is an all-in-one money management app that helps you end financial stress. With its simple and clean interface, it's easy to track your money, create budgets, and manage your debts.

Key Features:

Automatic Bill Reminders: The app helps you avoid late fees by reminding you of upcoming bills and transactions.

Debt and Loan Management: You can manage your debts, loans, and payment process in one place.

Multi-Currency Support: This feature is perfect for expats and world travelers who deal with multiple currencies.

Bank Account Syncing: The app supports syncing with major banks in Singapore, Malaysia, and other countries.

Pricing: The app offers a free version and a one-time purchase of a premium version. The premium version costs $27.00 for a one-time purchase.

Download: App Store | Google Play

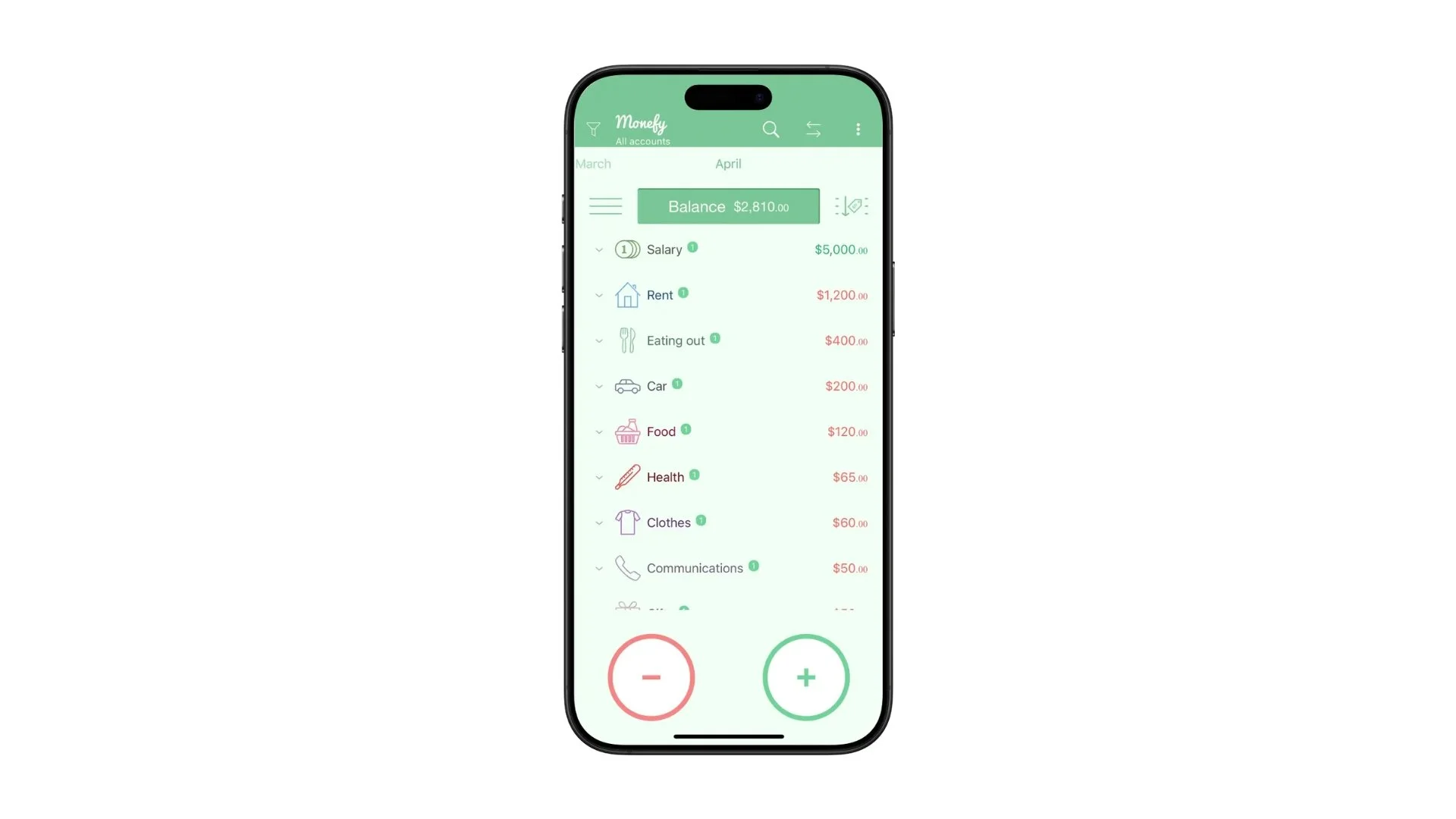

5. Monefy

Monefy is a simple and intuitive mobile expense tracker that helps you see spending patterns, control impulse purchases, and build wealth. It is a great choice for those who are looking for a simple, no-frills app that helps them budget efficiently.

Key Features:

Intuitive Interface: The app's simple interface makes it easy to add new records and manage your expenses.

Multi-Currency Support: This feature is perfect for expats and travelers who deal with multiple currencies.

Passcode Protection: The app offers passcode protection to help you safely manage your financial data.

Custom Categories: You can manage categories if the defaults do not work for you.

Pricing: The app offers a free version and a one-time purchase of a premium version. The premium version costs $5.98 for a one-time purchase.

Download: App Store | Google Play

How These Apps Fit into Your Broader Financial Plan

Budgeting apps are powerful tools for gaining a clear, real-time picture of your finances. They help you understand your spending habits and identify areas for improvement. However, this is just the first step.

At TallRock Capital, we believe that the data you gather from these apps is the foundation of a more comprehensive financial plan. A financial advisor can take these insights and help you:

Align Your Spending with Your Goals: We'll help you see how your spending habits impact your ability to achieve long-term goals like buying a home or securing your retirement.

Optimize Your Investments: We can take the money you've saved from your budget and help you invest it strategically for optimal growth.

Plan for Your Future: We can help you create a holistic financial plan that integrates your budget, investments, insurance, and estate planning, ensuring all aspects of your financial life are in sync.

Conclusion:

The right budgeting app can be a game-changer, helping you move beyond guesswork and into a world of financial clarity. By tracking your expenses, you're not just creating a budget; you're building a deeper understanding of your financial behavior.

Ready to turn your financial insights into a powerful, long-term plan? Contact TallRock Capital today for a complimentary consultation.

Disclaimer: This article is for informational purposes only. It is essential to consult with a qualified financial advisor for personalized guidance.